If you own commercial real estate (CRE) funded by a fixed-rate Commercial Mortgage-Backed Security (CMBS) loan, you are likely feeling pressure. A massive amount of CMBS debt is set to mature soon. This challenge is often called the “Maturity Wall.” It is forcing owners to find new financing to pay off large balloon payments quickly.

The problem is simple. Rising interest rates and tighter bank rules make traditional refinancing nearly impossible for many properties. This is especially true for assets that are struggling, such as some office or retail buildings.

This is where a private bridge loan for maturing CMBS debt becomes your best move. A bridge loan gives you the fast cash needed to pay off the balloon payment. It buys you the time you need to fix up your property and get ready for a long-term loan. It is the essential lifeline that helps you turn a tough challenge into a significant opportunity.

In this guide, we will look at the real risks you face. More importantly, we will show you how to use private bridge financing for CMBS loan maturity as your strategic solution.

Why the CMBS Maturity Wall is a Real Threat

The CMBS market provided great, low-rate financing for years. But now, that advantage is gone. When these 5- to 10-year loans reach their balloon date, they must be paid in full. If you cannot refinance, the debt transfers to a Special Servicer. This triggers a costly, stressful process.

The Scale of the Crisis: The Trillion-Dollar Problem

The scope of this challenge is enormous. Over $1 trillion in CRE loans is scheduled to mature in 2025 and the years following. Nearly $151 billion in private-label CMBS loans are maturing in 2025 alone.

A considerable portion of this debt needs immediate attention. Banks are stepping back from lending. This creates a funding gap that only specialized capital, like private debt funds, can fill.

The Office and Retail Reckoning: Where Default Risk Is Highest

Not all properties are at the same risk. The distress is heavily focused on specific sectors.

Office properties are struggling the most. In Q3 2025, the payoff rate for maturing office CMBS loans dropped to just 21.4%. This means nearly four out of five office properties could not secure traditional financing on time. Retail is also showing high maturity default risk.

Meanwhile, multifamily and industrial properties are generally faring better. Suppose your property is in the office or retail category. In that case, your risk of needing a fast-track solution is exceptionally high.

What are Your Options for Maturing CMBS Debt Without Refinancing?

When the balloon date hits, you really only have a few paths:

| Option | Outcome & Cost | Risk Level |

| Refinance (Failed) | You cannot secure a permanent loan due to rate, value, or occupancy issues. | High |

| Default/Special Servicing | Loan transfers to a servicer; penalties, default interest, and fees begin to pile up. | Catastrophic |

| Deed-in-Lieu or Sale | You surrender the property or sell it quickly, often at a steep loss. | High (Loss of Equity) |

| Private Bridge Loan | You pay off the CMBS debt quickly, stabilize the asset, and plan for a future refinance. | Managed (The best path forward) |

If traditional refinancing fails, a private bridge loan is the only path to keep and improve your asset while avoiding default.

The Traditional Refinancing Traps: Why Banks Say “No”

CMBS loans are designed to be inflexible. This makes it very hard to save a property if its cash flow drops before maturity.

The Defeasance Trap: Paying Off Early Is Too Expensive

CMBS loans carry strict prepayment penalties. The most common is defeasance. This process requires you to buy a portfolio of government securities usually US Treasury bonds to replace the cash flow of the original loan.

Defeasance is often prohibitively costly. This forces borrowers to wait until the exact maturity date to pay off the loan. This rigidity means that when the maturity date finally arrives, you must have the new financing in place, or you face immediate consequences.

The Special Servicing Nightmare: When the Clock Runs Out

If you miss the balloon payment, your loan will be transferred to the special servicer immediately. Maturity default is the main reason loans are now in special servicing.

The special servicer has a duty to the bondholders, not to you. This relationship is often adversarial. The financial penalties are severe :

- Default Interest: A much higher interest rate starts accruing immediately.

- Late Fees: You can be charged up to 5% of the entire loan principal.

- Servicer Fees: The fees paid to the special servicer can quickly negate any benefit you got from the original low CMBS rate.

Securing a private bridge loan for maturing CMBS debt is truly a CMBS loan default private bridge loan solution. It lets you interrupt this costly process before penalties wipe out your equity.

The Cash Flow Problem: Why Stabilized Lenders Say “No”

Permanent lenders, such as banks and agencies, look for a fully stabilized property. They focus on two key numbers:

- Debt Service Coverage Ratio (DSCR): Does the property’s Net Operating Income (NOI) generate enough cash flow to cover the new mortgage payment?

- Loan-to-Value (LTV) Ratio: Is your equity high enough? They often require an LTV of 65% or less.

Many transitional properties especially those in need of new tenants or repairs fail these tests. The CMBS structure itself prohibits substantial capital expenditure (CapEx) to fix these issues while the loan is active. This creates a vicious cycle: the property needs work to qualify for permanent debt, but the original loan prevented the work from being done. This highlights the key difference between bridge loan and permanent financing CMBS: a bridge loan funds the necessary property improvements.

The Solution: Private Bridge Financing for CMBS Maturity

A bridge loan is not just financing; it is a strategic tool for transformation. It gives you the immediate cash and the flexible capital needed to stabilize your assets.

What Is a Private Bridge Loan CMBS?

A bridge loan is short-term financing, usually 12 to 36 months. It is specifically designed to “bridge the gap” between your immediate capital need (paying off that CMBS balloon) and the time required to secure permanent, long-term financing.

The key difference from a bank loan? Private bridge lenders focus primarily on the asset’s value and your improvement plan, rather than on strict personal credit rules. These loans are flexible enough to finance value-add projects, such as renovations or lease-ups, that traditional CMBS or bank loans cannot.

Speed Wins: The Quick Close Private Bridge Loan CMBS Advantage

When a CMBS maturity date is approaching, time is your most valuable asset. Every day closer to maturity increases your risk of default.

- Traditional Bank Loans: Typically take 30 to 60 days (or more) to close.

- Private Bridge Loans: Can close in as little as 10 to 14 business days.

This speed is crucial. We bypass the lengthy underwriting process of traditional lenders by focusing on the property’s collateral and the viability of your exit plan. This ability to act fast can be the edge that saves your asset.

Funding Value: Private Capital for CMBS Debt Extension

The reason many CMBS loans fail is that the property needs work a new roof, better common areas, or a significant overhaul to attract new tenants.

Private bridge loans are unique because they are often structured to include funds for these critical capital improvements (CapEx). This is truly private capital for CMBS debt extension that works, because it helps you:

- Pay off the old CMBS debt.

- Fund the renovations needed to increase rent and occupancy.

- Increase the Net Operating Income (NOI) to qualify the property for a permanent loan in 1–3 years.

This strategic injection of capital turns a transitional property into a stabilized one, ensuring a successful, profitable exit.

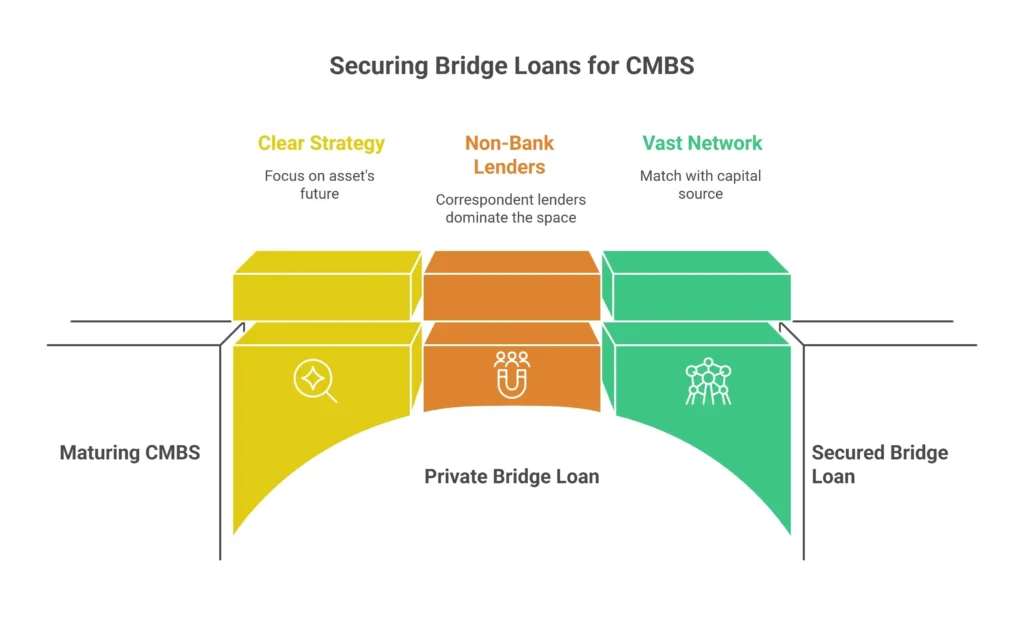

Securing Your Lifeline: The Private Bridge Loan Process

Getting a bridge loan requires a clear strategy focused on the asset’s future, not its past performance.

Who are the Bridge Loan Lenders for Maturing CMBS?

Traditional banks have pulled back from CRE lending. Now, specialized non-bank lenders like correspondent lenders, credit funds, and institutional investors dominate this space.

As a correspondent and table lender, we specialize in these complex, time-sensitive situations. We use our vast network of 1,000 private lenders and investors to match you with the exact capital source needed for your unique CMBS situation.

Eligibility and Underwriting: Focusing on the Asset

To be eligible for a bridge loan, the focus is placed on the property itself.

- Eligible Properties: Multifamily, office, retail, industrial, and hospitality properties are eligible. The property can be Class A, B, or C, as long as you have a plan to upgrade it.

- Underwriting Focus: We emphasize the property’s potential value and your exit plan. We need to see that the numbers work once the property is stabilized.

- Borrower Strength: While asset value is key, lenders often require the borrower to demonstrate a net worth of at least 25% of the loan amount and liquidity equal to 5% of the loan amount.

This asset-focused approach is critical for borrowers looking to secure private bridge loan for commercial real estate CMBS refinancing.

Terms and Costs: Understanding the Premium for Speed

Bridge loans cost more than permanent financing. This cost reflects the risk being taken and the speed provided.

| Key Bridge Loan Terms | Typical Details |

| Term Length | 12 to 36 months (short-term) |

| Interest Rate | Floating rate, often 7% or higher over an index |

| Amortization | Generally interest-only (IO) |

| Maximum LTV | Up to 75% of cost (LTC), capped at 70% of stabilized value |

| Fees | Origination fees up to 2% of the loan amount are common |

While the rates are higher, they are the necessary cost to avoid the far higher fees and financial damage caused by a CMBS default and special servicing. When you search for the best private bridge loan rates for CMBS, remember that flexibility and speed are often more valuable than a few basis points of interest.

Avoiding the Risks: Bridge Loan Pitfalls and How to Succeed

A bridge loan is temporary. Success is defined by your ability to move from the bridge loan to a permanent loan when the short-term is up.

The Biggest Threat: Lack of a Clear Exit Strategy

The single most significant risk of a bridge loan is defaulting on it. The lender requires a concrete, credible plan for paying off the bridge loan, often called a “takeout commitment”. If you do not have a solid exit strategy, you risk falling into another default scenario.

This risk is why managing the risks of maturing CMBS without bridge financing is crucial. You must use the 12-36 month window to execute your business plan and transform the property.

Strategic Stabilization: What to Do During the Bridge Term

The bridge period is your chance to fix the problems that caused the original CMBS refinancing failure. You must use the CapEx funds provided by the loan to:

- Renovate: Update the property to attract higher-quality tenants.

- Lease-Up: Aggressively fill vacant space to boost occupancy and NOI.

- Optimize: Implement modern property management to stabilize cash flow.

Your goal is to increase the property’s value and NOI to a level high enough to meet the LTV and DSCR requirements of permanent lenders.

Takeout Options: Bridge to Permanent Financing

After stabilizing the asset, you will exit the bridge loan by securing long-term debt. Your options are robust :

- New CMBS Issuance: The CMBS market is strong, with issuance volumes tracking toward $120 billion in 2025. A stabilized property can easily re-enter this market.

- Agency Loans (Fannie Mae/Freddie Mac): Ideal for stabilized multifamily assets.

- Traditional Bank/Life Company Loans: Available for properties that are now fully stabilized and cash-flowing.

These options provide the financing for a maturing CMBS debt alternative that you need to move from short-term stress to long-term stability.

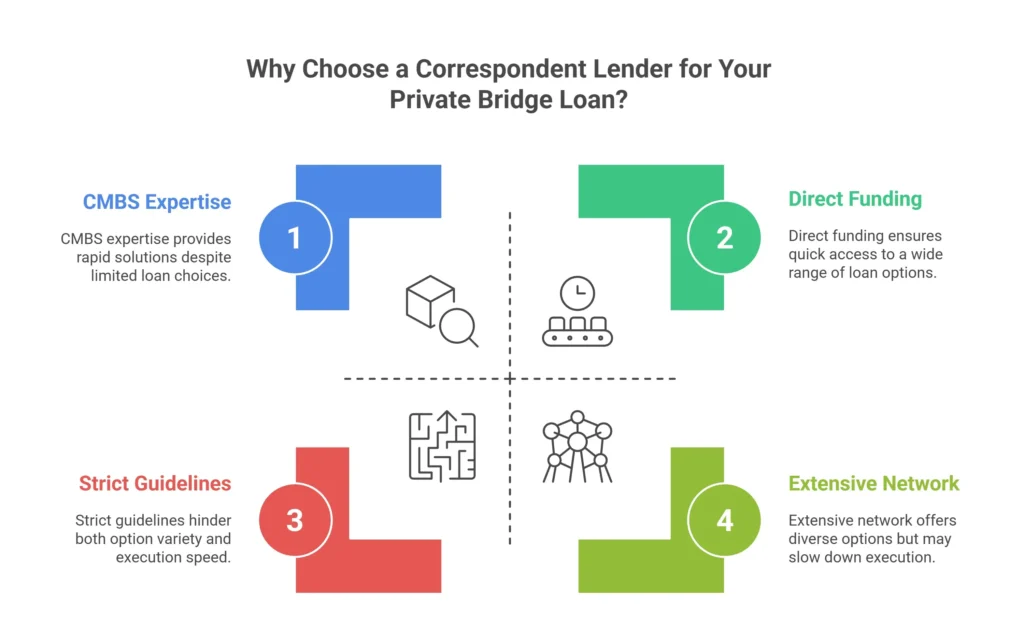

Why Choose a Correspondent Lender for Your Private Bridge Loan?

When facing a ticking clock on a CMBS maturity, you need more than just a loan; you need expertise and execution certainty.

The Correspondent Advantage: Speed, Flexibility, and Variety

We are a correspondent and table lender. This structure is a massive advantage for you:

- More Options: We are not limited by strict bank guidelines like depository institutions. We offer assistance with 75 varieties of loan types, including hard money and bridge loans, ensuring you get the perfect fit.

- Greater Control and Speed: We fund your loan directly, often with our own money, before selling it to an investor. This means we have more control over the process, leading to a smoother and faster experience overall critical for those tight CMBS deadlines.

- Market Expertise: We connect you to a platform of 1,000 private lenders and investors. This network is crucial when looking for private bridge loan providers specializing in CMBS debt, as they understand the specific risks involved.

Your Trusted Partner: 30 Years of Underwriting Expertise

We specialize in commercial real estate construction, including ground-up, new construction, remodeling, renovation, fix-and-flip, tear-and-rebuild, fix-and-rent, and fix-and-hold projects. These are precisely the kinds of transitional projects that require bridge financing to succeed.

With 30 years of capability and expertise as an underwriter, we know how to structure a deal that accounts for the special rules of CMBS debt and sets you up for a flawless long-term exit. We cater to both experienced and novice investors, providing the guidance you need to enter or thrive in the real estate sector.

Conclusion: Take Control of Your CMBS Maturity

The looming CMBS Maturity Wall is a significant challenge, but it does not have to mean default. For transitional properties, the rigid structure of the original CMBS loan is the problem. The flexible, rapid capital of a private bridge loan for maturing CMBS debt is the solution.

This strategic move allows you to interrupt the default process, fund necessary renovations, and position your property for a successful, high-value refinance.

Do not wait until the special servicer takes control. If your balloon payment is due in the next 12 months, the time to plan your escape route is now. Contact us today to learn how our 30 years of underwriting experience and flexible, fast financing options can secure your future. Let us fast-track your refinance together.

FAQs

1. What happens if I use a bridge loan to pay off my CMBS debt but then fail to secure the long-term refinance (takeout)?

Suppose your permanent financing fails to materialize by the end of the bridge loan term. In that case, the bridge lender will typically enforce its rights because it holds a security interest in the property, often a first charge. This critical failure could result in the appointment of a receiver or the forced sale of the collateral property to recover the outstanding funds. Failure to execute the planned exit strategy can result in the loss of your asset and damage your reputation with future lenders, making it much harder to secure financing for your next venture.

2. Are private bridge loans for CMBS maturity typically recourse or non-recourse debt?

While CMBS loans are typically non-recourse, most private bridge loans are also structured as non-recourse debt, meaning the lender’s recourse is primarily limited to the collateral property. However, these loans almost always include industry-standard “bad act” carve-outs, which are specific situations like fraud, unauthorized sale of the property, or misappropriation of funds that allow the lender to pursue the borrower personally. For properties that are particularly transitional or require higher leverage, a lender may require limited recourse.

3. Are there any specific property types that are generally ineligible for commercial bridge financing?

Private bridge lenders are highly flexible and finance a wide variety of assets, including multifamily, office, retail, and industrial properties. However, properties or situations that involve significant operational complexity or financial risk may be ineligible. This includes projects currently engaged in litigation or insolvency proceedings. Similarly, properties requiring extensive, critical repairs that make stabilization highly uncertain, or those structured under specific single-entity ownership models, might not qualify for financing intended for stabilization and quick refinance.

4. How soon before my CMBS maturity date should I apply for a private bridge loan?

You should begin planning your exit strategy for your maturing CMBS loan up to 12 months before the final maturity date. While the private bridge loan closing process is rapid often taking only 10 to 14 business days starting early is vital. This lead time ensures you have time to prepare all required documentation, execute property improvements, and provide the funds are ready to meet the balloon payment deadline. Waiting until the last 30 days significantly increases the risk and cost of the transaction due to urgency.

5. Can a bridge loan be used to prepare a multifamily property for an Agency (HUD) loan takeout?

Yes, this is a widespread and strategic use case, particularly for multifamily properties. HUD (Housing and Urban Development) financing is known for offering competitive rates and long terms. Still, the origination and closing process can be lengthy. A bridge loan is often used as a “bridge-to-HUD” solution, providing the capital needed to pay off maturing CMBS debt and stabilize the property. At the same time, you navigate the lengthy application and approval timeline for the permanent HUD financing.

Comments are closed