Companies use commercial construction loans for building or remodeling industrial property costs. This could include office buildings, shopping malls, new companies, or even repairs to buildings that are already there.

Remember that these are only short-term loans to get you through the building process. They are short-term loans for when the building is finished.

Picking the correct type of interest rate (fixed vs. variable) is very important because it affects how much your project will cost during building. If you’d like, we can talk about that in more depth.

Fixed Rate Commercial Construction Loans

Advantages of Fixed Rate Loans

Fixed-rate commercial construction loans have many benefits, especially for people who want to keep their project funds stable and predictable. The points you made are broken down below:

- Predictable monthly payments: This is an essential feature. With a fixed rate, you know the interest rate from the loan’s start. This means your monthly payments will stay the same for the whole loan time, even if the market goes up or down. This makes creating a budget and planning for your construction project’s cash flow much more accessible.

- Stability for budgeting and project management: Your fixed payments give you a good idea of how much the job will cost to finance. This stability makes it easier to manage your budget. It keeps you from having any shocks that could throw off your project schedule.

- Less risky option for borrowers concerned about rising interest rates: If interest rates increase, a fixed-rate loan will protect you from those rises. You get a reasonable rate upfront, protecting you from possible market changes. It can be beneficial in this way, especially for projects that take longer to build.

Borrowers who value security and want to avoid the possible changes with variable interest rates should look into fixed-rate loans. But there may also be some problems to think about. Would you like to look into those next?

Disadvantages of Fixed Rate Loans

Along with the benefits we discussed earlier, fixed-rate loans can have some problems. Let’s take a closer look at the two things you brought up:

- Higher initial interest rate: With a fixed-rate loan, the lender doesn’t have to worry about rising interest rates so they may charge a slightly higher starting rate. This shows how sure they are that they will make a fixed amount.

- Limited savings if interest rates fall: If market interest rates decrease while your loan is still being paid off, you won’t save money from those lower rates. You can’t change the set rate you agreed to at the start.

Fixed-rate loans give you security and predictability, but they may cost a little more upfront and make it harder to change if interest rates go up in your favor. Ultimately, the best option for your project will depend on how willing you are to take risks and how you think interest rates will change.

Variable Rate Commercial Construction Loans

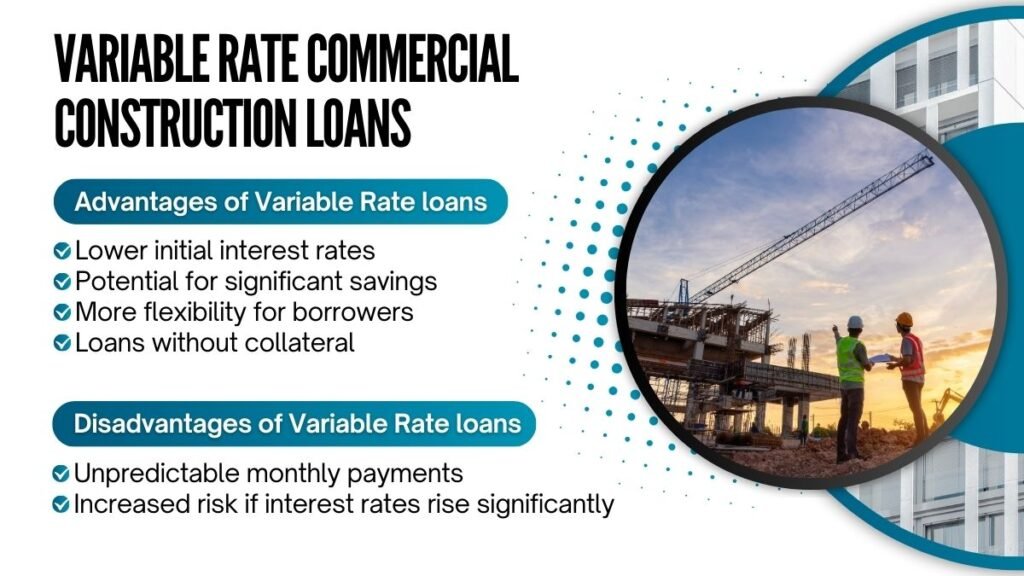

Advantages of Variable Rate loans

There are some different benefits to variable-rate commercial construction loans, especially for people who are okay with taking some risk:

- Lower initial interest rates: This is one of the best things about variable-rate loans. If the lender doesn’t promise a fixed rate, they might be willing to give a lower interest rate upfront than on a fixed-rate loan. Right at the start of your job, this can save you a lot of money.

- Potential for significant savings if interest rates decrease: You should get a value if interest rates decrease during your section time. When rates go down, so make your monthly payments. This could save you a lot of money over the life of the loan.

- More flexibility for borrowers with shorter construction timelines: The ability to change rates and the possibility of lower initial rates can be helpful for projects with shorter building timelines. Imagine that you are sure you can finish building before interest rates go up a lot. A loan with a flexible rate is a good choice.

However, it’s essential to remember that variable-rate loans can also have problems. Would you like to look into those next?

Disadvantages of Variable Rate loans

Some things could go wrong with commercial construction loans with variable rates that you should think about carefully:

- Unpredictable monthly payments: With a variable-rate loan, unlike a fixed-rate loan, your monthly payments can change based on how the market interest rate changes. Planning and budgeting for your project’s money might be more challenging.

- Increased risk if interest rates rise significantly: During the time you build, your monthly payments might also increase if interest rates go up considerably. This could strain your project budget and make it harder for you to make money.

The most important thing to remember is that variable-rate loans can save you money upfront and give you more freedom. Still, they put you at risk of having your payments change without warning. So, it’s essential to think about how much risk you’re willing to take and make a plan for how to handle possible interest rate rises.

Choosing the Right Interest Rates for Your Project

You gave me a great way to think about picking the correct interest rate for a commercial construction loan. Here is a list of the most important things to think about:

Factors to Consider

- Project timeline and construction budget: The length of your building job will significantly affect your choice. Fixed rates are more stable when working on longer projects. In comparison, flexible rates are better for shorter projects with lower starting costs. Also, think about your budget. Can you handle payment changes if you get a loan with a fluctuating rate?

- Current interest rate environment and economic forecasts: Find out what the current interest rate situation is and what the financial estimates are. Are rates likely to go up or down? This will affect whether a variable or set rate would be better.

- Risk tolerance of the borrower: How okay are you with the idea that interest rates might change? A set rate might be best if you value stability and knowing what to expect. If you’re willing to take some risks and think that interest rates might go down, a flexible rate might be a good choice.

- Business goals and long-term financial plans: Consider your long-term cash and business goals. How will paying back the loan affect your future purchases and cash flow?

Consulting with a Commercial Construction Loan Expert

Of course! Discussing your project with a commercial construction loan expert who knows what they’re doing is essential. This is why:

- Understanding loan options: A lender can tell you about the pros and cons of both fixed- and variable-rate loans and help you find the right solution that fits the needs of your project.

- Market expertise: A person specializing in commercial construction loans knows about market changes and interest rate predictions. They might give you helpful information to help you make an intelligent choice.

You can better understand your financing choices if you talk to a professional. You can pick the best interest rate that fits your project’s needs and your level of comfort with risk.

Correspondent Lender vs. Traditional Lender for Commercial Construction Loans

You can go in two main directions regarding commercial construction loans: traditional and correspondent lenders. Here is a quick list of each:

Correspondent Lender

A correspondent lender is like a go-between who has ties. They work with several banks and other lenders to give users access to more loan programs and possible lenders. They do much of the work, from the initial application to financing, which checks to see if your project can make money. It’s not likely that commercialconstructionloans.net is a direct lender. Instead, it’s more likely that an associate lender works with other lenders.

Benefits of using a correspondent lender

- More comprehensive Network: You can get the best financing for your project if you work with correspondent lenders because they give you access to more loan options and lenders.

- Simplified Process: Many times, correspondent lenders have screening experts on staff, making the application process easier for you. They can help you complete the paperwork and ensure your application is well-organized for lenders.

- Competitive Rates: Correspondent lenders can get you better interest rates by working with multiple loans.

Traditional Lender

A traditional lender is a bank or financial institution giving direct commercial construction loans. You would work directly with their loan officers and lenders during the process.

Benefits of using a traditional lender

- Direct Relationship: You can talk to the loan servicer directly if you go with a standard lender. This group is in charge of your monthly payments and loan management. This can help make communication clear and troubleshooting easy.

- Faster Turnaround (Potentially): If you go through a standard lender, the time it takes to approve your loan might be shorter, depending on how big the lender is and how they run their business.

In the end, your wants will determine the best option. For example, you want a lot of choices and possibly better prices. A traditional lender might be a good choice. A correspondent lender is best if you need a direct connection and a faster turnaround. It would be best to look at what both lenders offer to find the best one for your job.

How a Superbroker Can Help Secure Your Commercial Construction Loan

A “super broker” is like a heavyweight in the loan search process regarding commercial construction loans. Sometimes, they go above and beyond what an average correspondent lender does. They can help you get your commercial construction loan in the following ways:

- Expertise in Complex Loans: Superbrokers know much about the different types of available commercial construction loans. They know how to deal with the complicated world of varying loan structures, government programs, and specialized financial options. This knowledge is beneficial in locating the best loan for your project requirements.

- Advocacy and Negotiation: Superbrokers will fight for you through the loan process. They use their knowledge and connections with lenders to get you the best terms possible. This includes getting reasonable interest rates, loan structures, and other essential loan parts.

- More comprehensive Lender Network: Like correspondent lenders, super brokers can connect you with a vast network of lenders, such as traditional lenders, regional banks, private lenders, and alternative funding sources. This broad reach makes it much more likely that you’ll find the best financing choice for your project.

When you hire a super broker, you get access to a wide range of loans and a particular set of skills. This can help a lot for projects that are hard to understand, users with special needs, or people who want the best loan terms. It’s essential to keep in mind, though, that super dealers may charge more for their services.

Fixed vs. Variable Rate Construction Loans: Key Considerations

Picking the correct interest rate for your commercial construction loan is a critical choice that can significantly affect the money you have for the project. Just a quick review:

- Fixed Rate Loans: Locked-in interest rates for the whole loan time give you stability and predictability. This is great for making budgets and managing risk, but the starting rate may be slightly higher.

- Variable Rate Loans: You may have lower interest rates initially; if rates fall, you could save a lot of money. But they put you at risk of not knowing your monthly payments if rates go up.

Choosing the Right Loan: Professional Guidance Matters

Your project’s best interest rate type depends on several things, such as its schedule, your willingness to take risks, and the current state of the economy. Think about these things carefully, be bold, and get help from a professional.

A commercial construction loan expert can advise you, review your loan choices in detail, and help you through the process.

CommercialConstructionLoans.net: Your Helper in Getting the Best Loan

You can use CommercialConstructionLoans.net to find a loan. It is likely a cousin lender or super broker. They connect you with a group of lenders and help you with the following:

- Learn about your loan choices.

- Find the rates and terms that are the best deal.

- Make the entry process more accessible.

You can use commercialconstructionloans.net to improve your chances of getting the best financing for your commercial construction job, whether you need a fixed or variable-rate loan. Remember that getting the right loan can make or break your project.

FAQs

What are commercial construction loans?

Short-term loans to pay for the costs of building or fixing up business properties.

What are the benefits of using a commercial construction loan?

Businesses can finance projects without having to pay for them all at once. This makes it easier to finish projects and frees up working cash that can be used for other things.

What is a fixed-rate commercial construction loan?

The interest rate is fixed at the start of the loan, so the monthly payments are always the same.

What is a variable rate commercial construction loan?

Interest rates change based on how the market is doing. This could mean lower starting rates but less stable monthly payments.

What factors should I consider when choosing a loan?

- Budget and schedule for the project

- Current interest rate situation Tolerance for risk

- Plans for the business and its money in the long term

Should I consult with a commercial construction loan expert?

Yes! They can tell you about the different loan choices, give you information about the market, and help you pick the best loan for your project.

What is a correspondent lender?

A person in the middle who knows a lot of different lenders and can offer borrowers a more comprehensive range of loan plans and even better rates.

What is a superbroker?

A specialized intermediary who knows a lot about complicated loan choices and can help borrowers get better terms from a vast network of lenders.

Comments are closed